Renewable Power Project Finance

Having unlocked the next part of this Theme Vitrine , here is the deal:

Power Africa

Africa today has just about as many people as China or India: “Today some 600 million people (46%) do not have access to electricity and around 900 million people (69%) lack access to clean cooking.”

- The African power infrastructure represents a massive catch-up opportunity

- Need for reliable and affordable power to cope with strong demographic & economic growth

- $40bil every year for the next 25 years needs to be invested into African power infrastructure, just for it to catch up with a developing countries average

- Appropriate government policies and regulations are paving the way for large private sector participation

- International focus on African Power: President Obama’s “Power Africa Initiative” (with a deal tracker), World Bank & DFI funding, private equity & asset managers channel funding and support into the sector

- Exponential growth in African power sector to provide risk managed superior returns

Investment metric until 2040

Investment philosophy / guidelines

- Focus on African power generation & transmission

- In most countries key investor risks are addressed

- Well regulated Public Private Partnerships (PPPs) that support Independent Power Producers (IPPs)

- Buy-in from governments and utilities

- Debt / mezz support from Development Finance Institutions (DFIs)

- Political insurance and credit enhancements (MIGA PRI and World Bank PRG)

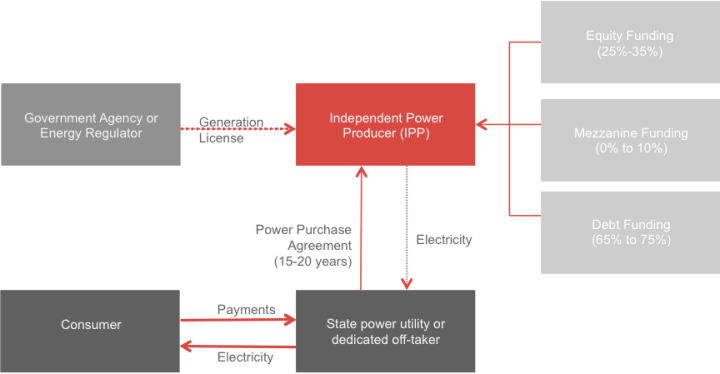

- IPP | Typical IPP concession structure

- Only invest in countries that have

- Stable political & socioeconomic outlook

- Relevant IPP or concession legislation in place

- Functioning exchange control including repatriation of capital / dividends

- Invest in straight-forward IPP generation and concession models

- Avoid complex revenue models

- Only invest in bankable projects

- Co-invest with reputable sponsors, DFIs and banks

- Avoid exposure too early, i.e. in principal development (PD) & development capital (DC)

- Sweet spot between financial close (FC) & commercial operation date (COD)

One should note that the African power sector has massively changed over the past five years. Most of the projects reaching financial closing today have gone through a highly competitive & structured international tender. In most aspects & most countries, the entrepreneurial touch is gone, with the governments getting the assistance from the WB et al to structure the project tenders, and even giving guarantees on top. So then the whole world responds, depressing what used to be solid developer returns (some solar tenders get over a hundred bidders). There is a lot of balance sheet financing as well, with large corporations bidding for solar farms of 100 MW and more. Agile risk-taking developers are just about a dying breed…

Typical power project life-cycle

Building blocks, important factors & sweet spots:

1.

2.

3.

4.

Selection process / due diligence

- Political risks

- Whenever possible consider Political Risk Insurance or Guarantees

- Government programme support agreements

- Tax incentives

- Permitting

- Change in law provisions

- Sovereign waiver

- Quality of off-taker

- Analyse financial strength and external support, track record

- Power purchase and concession agreements

- Clear tariff, indexation structure and calendar

- EUR or USD pegged pricing or local currency hedge

- Collection and escrow account mechanism, standard set of default remedies and guarantees

- Environmental and social impacts

- Potential social and reputation risks

- Follow World Bank or African Development Bank social and environmental standards

- Ensure EISA performed by authorised consultant

- Quality of sponsor

- Developer track record, size of co-investment

- Quality of the power resource

- Independent verification of resource quality, e.g. wind, solar, hydro, gas, bio, etc.

- Guaranteed fuel or feedstock supply for bio-fuel

- Plant construction (engineering, procurement and construction)

- Reputable EPC contractor

- EPC contract terms and guarantees

- Technology

- Commercially proven technology

- Performance warranties

- Possible ECA guarantees

- Operations and Maintenance

- Reputable O&M contractor

- O&M contract terms and guarantees

- Funding structure

- Assess quality of lenders

- Scrutinise financial model

- Assess risk of fixed vs floating interest payments

- Assess risk in timing, size and frequency of debt capital repayments

- Calculate a realistic expected project IRR

Investment themes for a $4bn opportunity

Sources of funding by srage

And their key characteristics

Renewable power project finance & development in Africa has certainly become easier over the last five or so years, with Power Africa, African Development Bank, the World Bank, et al, all actively supporting and following investments on the continent. This has led to an increase in the project quality & quantity, and one should stick to best practices (+/-) wherever the project is… so to conclude, the last section will provide a typical design for a wind power project..

Theme Contribution

Enterprise Power Limited

en/power has been created to develop IPP and off-grid ventures from an early stage in sub-Saharan Africa. Our business model is to yield investment multiples through the successful development of power generation projects from concept to execution with exit opportunities at financial close or commercial operations date

African Resources Capital

African Resources Capital was established in 2009 as a financial advisory firm specialising in structuring and raising finance for medium size businesses in sub-Saharan Africa. It has grown into a multi-faceted business, operating across four industrial sectors – namely energy, mining, agribusiness and healthcare

Theme Related Tracker

Trends and forecasts monitor:

- OPEC+ members agree to larger-than-expected oil production hike in Auguston July 5, 2025

Eight OPEC+ producers agreed to lift crude output by 548,000 barrels per day in August, exceeding the anticipated 411,000 barrels per day rate.

- Ethereum is powering Wall Street's future. The crypto scene at Cannes shows how far it's comeon July 5, 2025

Ethereum’s institutional adoption is accelerating, with BlackRock, Deutsche Bank, Coinbase, and Kraken all building directly on its rails.

- European renewable stocks to watch as Trump's megabill clears Congresson July 4, 2025

Revisions to the "big beautiful bill" are a relief to a sector already grappling with funding challenges, competition from China and tariff uncertainty.

- Trump megabill gives the oil industry everything it wants and ends key support for solar and windon July 3, 2025

President Donald Trump wants the U.S. to rely on oil, gas, coal and nuclear to meet its energy needs.

- OpenAI says Robinhood's tokens aren't equity in the companyon July 2, 2025

OpenAI said it was not involved in Robinhood’s launch of tokenized shares in Europe, warning users the assets were issued without its approval.

- Robinhood stock hits $100 as it roars 30% since S&P 500 snubon July 2, 2025

CEO Vlad Tenev said the goal is to merge crypto infrastructure with traditional finance by putting real products in customers’ hands.

- Clean energy stocks jump after tax on solar and wind projects is removed from Trump's big billon July 2, 2025

The tax was ultimately struck from the final version of the bill, a modest win for an industry that is under attack from the Trump administration.

- An Energy Star inside U.S. homes is under attack from Trump, with the cost to homeowners uncertainon July 1, 2025

Donald Trump has railed against modern dishwashers, washing machines, light bulbs, showerheads and toilets. He's turned his ire into a presidential edict.

- Robinhood expands its global push, minutes from crypto chief's old cramped apartment in Canneson July 1, 2025

Robinhood is offering tokenized U.S. stocks and ETFs across Europe, crypto staking in the U.S., perpetual futures for eligible EU traders, and a new blockchain.

- Robinhood gives out tokens of OpenAI and SpaceX in Europe. Stock hits recordon July 1, 2025

Robinhood rolled out tokenized shares of OpenAI and SpaceX to users in Europe, its first step toward making private equity broadly accessible via blockchain.