Renewable Power Project Finance

Having unlocked the next part of this Theme Vitrine , here is the deal:

Power Africa

Africa today has just about as many people as China or India: “Today some 600 million people (46%) do not have access to electricity and around 900 million people (69%) lack access to clean cooking.”

- The African power infrastructure represents a massive catch-up opportunity

- Need for reliable and affordable power to cope with strong demographic & economic growth

- $40bil every year for the next 25 years needs to be invested into African power infrastructure, just for it to catch up with a developing countries average

- Appropriate government policies and regulations are paving the way for large private sector participation

- International focus on African Power: President Obama’s “Power Africa Initiative” (with a deal tracker), World Bank & DFI funding, private equity & asset managers channel funding and support into the sector

- Exponential growth in African power sector to provide risk managed superior returns

Investment metric until 2040

Investment philosophy / guidelines

- Focus on African power generation & transmission

- In most countries key investor risks are addressed

- Well regulated Public Private Partnerships (PPPs) that support Independent Power Producers (IPPs)

- Buy-in from governments and utilities

- Debt / mezz support from Development Finance Institutions (DFIs)

- Political insurance and credit enhancements (MIGA PRI and World Bank PRG)

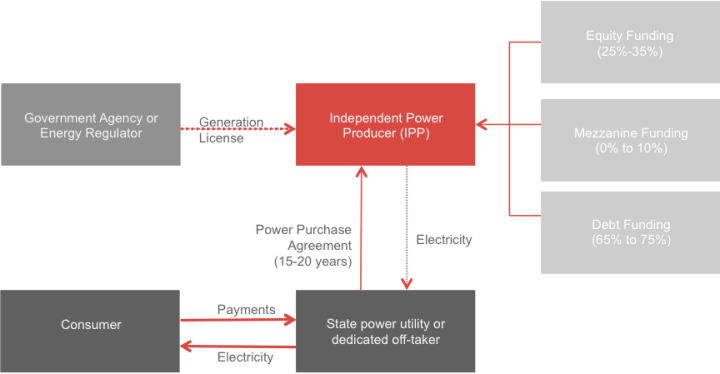

- IPP | Typical IPP concession structure

- Only invest in countries that have

- Stable political & socioeconomic outlook

- Relevant IPP or concession legislation in place

- Functioning exchange control including repatriation of capital / dividends

- Invest in straight-forward IPP generation and concession models

- Avoid complex revenue models

- Only invest in bankable projects

- Co-invest with reputable sponsors, DFIs and banks

- Avoid exposure too early, i.e. in principal development (PD) & development capital (DC)

- Sweet spot between financial close (FC) & commercial operation date (COD)

One should note that the African power sector has massively changed over the past five years. Most of the projects reaching financial closing today have gone through a highly competitive & structured international tender. In most aspects & most countries, the entrepreneurial touch is gone, with the governments getting the assistance from the WB et al to structure the project tenders, and even giving guarantees on top. So then the whole world responds, depressing what used to be solid developer returns (some solar tenders get over a hundred bidders). There is a lot of balance sheet financing as well, with large corporations bidding for solar farms of 100 MW and more. Agile risk-taking developers are just about a dying breed…

Typical power project life-cycle

Building blocks, important factors & sweet spots:

1.

2.

3.

4.

Selection process / due diligence

- Political risks

- Whenever possible consider Political Risk Insurance or Guarantees

- Government programme support agreements

- Tax incentives

- Permitting

- Change in law provisions

- Sovereign waiver

- Quality of off-taker

- Analyse financial strength and external support, track record

- Power purchase and concession agreements

- Clear tariff, indexation structure and calendar

- EUR or USD pegged pricing or local currency hedge

- Collection and escrow account mechanism, standard set of default remedies and guarantees

- Environmental and social impacts

- Potential social and reputation risks

- Follow World Bank or African Development Bank social and environmental standards

- Ensure EISA performed by authorised consultant

- Quality of sponsor

- Developer track record, size of co-investment

- Quality of the power resource

- Independent verification of resource quality, e.g. wind, solar, hydro, gas, bio, etc.

- Guaranteed fuel or feedstock supply for bio-fuel

- Plant construction (engineering, procurement and construction)

- Reputable EPC contractor

- EPC contract terms and guarantees

- Technology

- Commercially proven technology

- Performance warranties

- Possible ECA guarantees

- Operations and Maintenance

- Reputable O&M contractor

- O&M contract terms and guarantees

- Funding structure

- Assess quality of lenders

- Scrutinise financial model

- Assess risk of fixed vs floating interest payments

- Assess risk in timing, size and frequency of debt capital repayments

- Calculate a realistic expected project IRR

Investment themes for a $4bn opportunity

Sources of funding by srage

And their key characteristics

Renewable power project finance & development in Africa has certainly become easier over the last five or so years, with Power Africa, African Development Bank, the World Bank, et al, all actively supporting and following investments on the continent. This has led to an increase in the project quality & quantity, and one should stick to best practices (+/-) wherever the project is… so to conclude, the last section will provide a typical design for a wind power project..

Theme Contribution

Enterprise Power Limited

en/power has been created to develop IPP and off-grid ventures from an early stage in sub-Saharan Africa. Our business model is to yield investment multiples through the successful development of power generation projects from concept to execution with exit opportunities at financial close or commercial operations date

African Resources Capital

African Resources Capital was established in 2009 as a financial advisory firm specialising in structuring and raising finance for medium size businesses in sub-Saharan Africa. It has grown into a multi-faceted business, operating across four industrial sectors – namely energy, mining, agribusiness and healthcare

Theme Related Tracker

Trends and forecasts monitor:

- Oil surges 35% this week for biggest gain in futures trading history dating back to 1983on March 6, 2026

The oil market is worried that Gulf countries will have to shut production if tankers are unable to pass through the Strait of Hormuz.

- Trump admin announces $20 billion reinsurance program for oil tankers during Iran waron March 6, 2026

Tanker traffic through the Strait of Hormuz remains at a standstill as the Iran war engulfs the region.

- Trump says no deal with Iran to end war without 'unconditional surrender'on March 6, 2026

The futures price of the global benchmark Brent crude oil rose, breaking $90 per barrel, after Trump posted his demand to Iran to end the war.

- Analysis: Tough jobs report puts Trump's Iran war plans to the teston March 6, 2026

The economy is showing signs of slowing as the Iran war quickly pushes up gas prices.

- Europe faces a 'massive' gas price shock from Iran war — and these three sectors will be hit hardeston March 6, 2026

The Iran war has sent oil and gas prices soaring, creating huge risks in Europe's key energy-intensive sectors.

- Trump wants U.S. Navy to escort tankers through the Gulf. Why that plan may not workon March 6, 2026

A backup of oil tankers in the Persian Gulf is disrupting supplies, and will only get worse the longer the Strait of Hormuz is closed.

- How the Iran conflict is spreading — in pictureson March 6, 2026

Images published Thursday showed destruction across Tehran after nearly a week of strikes on Iran's capital.

- U.S. offers India a 30-day waiver for buying Russian oil as Iran war deepens energy supply worrieson March 6, 2026

U.S. has given India a waiver to buy Russian oil for 30 days as conflict in Middle East impacts global energy supply.

- U.S. crude oil tops $80 per barrel as escalating Iran war disrupts global fuel supplieson March 5, 2026

Oil prices have surged about 20% this week as the U.S.-Iran war engulfs the Middle East.

- Trump has an AI data center problem ahead of the midterms — with no easy solutionson March 5, 2026

Grassroots opposition to data centers is growing in communities across the U.S. as people blame the facilities for high utility bills.