PIPE Investment into Gold Mining

You are continuing your Theme Vitrine read:

Why Africa?

Africa is consistently represented in numbers among the fastest growing economies globally (EIU/Economist)

- Increased political stability and democratic changes

Significant improvements in infrastructure support

- Power, transport, water, human capacity

- 30% of total IFC commitments go to Africa

Demographic size, growth and mobility

- Approximately the same aggregate GDP to Middle East

- Three-times more people than the Middle East

Good yet virgin geologies in many parts of the continent

- Mining assets neglected more than elsewhere in the world, while its costs of production can be kept under control

- Mineral content typically higher than in other world regions which have been exploited for longer periods than Africa

Africa Benefits:

- Vast untouched, under-tapped, undeveloped potential is highest of populated workable continents

- Large deposits are still being found in Africa, and as infrastructure & power are coming into Africa, it becomes a cornerstone and right time to own the best African assets

- Strong human resources potential and not as costly as on other continents, coupled with fast permitting and inviting communities

- African mines can have exceptionally good economics; unlike say the Americas with many environmental and political bottlenecks

- In certain key areas of Western, Central and Eastern Africa there are good chances to get low cost and fast payback on large assets

- Western Africa has no high mountains which makes it easier for mining; while being able to mine in weather-oxidised conditions

- In most regions gold mining benefits from predominantly dry environments with proximity to water (even if seasonal)

- Less competition, and generally more friendly / transparent for foreign investors

Contract Mining Case Study:

- Contract mining ties in well with mining businesses, especially for smaller mines which may want to avoid owning and transporting equipment & people

- Dependent on the mine size & life, as well as the significance of mining costs overall, the owner needs to do a detailed cost-benefit analysis

- This choice extends through all the functions involved from equipment ownership & maintenance to loading & hauling, de-watering, ground support, dumps and stockpile maintenance, rehabilitation, feed crusher, etc.

- Contract mining companies can offer a number of advantages to mine owners including:

- Larger dose of flexibility & scalability

- Smaller dose of capital & risk

- A pool of smaller gold assets in say Ghana, like those of Abzu Gold, Castle Peak Mining and Ami Resources could greatly benefit from a relationship to a contract service company present on the ground

- Contract miners also tend to get higher leverage than the resources companies – on average a third opposed to a quarter financed by debt

- Some of this extra access to financing could trickle down in advances to the mine owners

African mineral sweet spots:

Africa has more than gold though:

So for example, we have in the past looked at following countries / clusters with related minerals and/or concepts:

- DRC & Zambia: Africa’s largest Copper ± Cobalt ± Tantalum

- Tanzania & Burkina Faso: top 5 Gold producers on the continent

- Burkina Faso, Ivory Coast & Ethiopia: Centamin concessions

- Madagascar: Ambatovy nickel-cobalt mine

- Niger & Namibia: Uranium

- Angola: Diamond production concepts ± Gold & Copper potential

- EAST AFRICA: Gold production

- SOUTHERN AFRICA: Copper & Precious metals group ± Platinum development ± Steel making & other higher-value specific metals

- NORTH AFRICA: Base metals & Precious metals vein ± Under-appreciated assets & exceptional exploration opportunities

- CENTRAL AFRICA: Copper ± Gold ± Tin, tantalum & tungsten ± Rare earth deposit

- WEST AFRICA: Gold deposit ± Manganese production ± Bulk commodity assets

But let’s stay on track…

Ghana Case Study

Ghana Gold Belt Geology:

Before gaining independence from Britain in 1957, Ghana was called the Gold Coast. The gold fields lie in the southwest and western part of the country. They consist of five parallel, evenly spaced volcanic belts trending southwest to northeast and averaging some 400 km in length. In order, starting from the east near the capital city of Accra, the belts are named the Kibi-Winneba, the Ashanti, the Sefwi-Bibiani, the Bui-Banda, and the Bole-Nangodi.

Between the belts are sedimentary basins punctuated by masses or intrusions of igneous rocks, mainly granites. Gold deposits are found along the margins of the volcanic belts, called “shear zones”, where the intrusions met the volcanic rocks. Heat and tectonic pressures chemically altered metallic compounds, producing sulfides and arsenides of gold which then percolated through the host rock and were deposited in fractured quartz veins.

The most prolific of the belts by far is the Ashanti Belt. On its eastern margin are Golden Star’s Wassa mine and Newmont’s Akyem. Ghana’s most important gold mines, however, are on the western margin: AngloGold Ashanti’s Obuasi and Iduapriem, Golden Star’s Bogoso and Prestea, GoldFields’ Tarkwa, and Endeavour’s Nzema.

There are fewer mines in the more westerly belts, but some of them are particularly notable. In the Sefwi-Bibiani Belt there are Resolute’s Bibiani, Kinross’s Chirano, and Newmont’s Ahafo. The Bole-Nangodi Belt stretches from Kinross’s Bole mine on the border with Ivory Coast beyond Nangodi to the Youga mine in Burkina Faso.

Interestingly, although exploration is still confined largely to belt margins, advanced geochemical and geophysical techniques have found significant gold deposits in the basins. An example is Asanko Gold’s Esaase prospect, in the Kumasi Basin between the Ashanti Belt and the Sefwi-Bibiani Belt.

Ghana catching up with South Africa

Ghana Gold Snapshot:

- Ghana has a long history of gold mining, being a global top ten market by reserve and by production

- 2nd largest gold producer in Africa, dominated by large scale mining companies

– Bulk open-cast mining with lower technology adaptation

– Other important minerals are manganese, bauxite, aluminium & diamonds - Strategic geographic / trade position in West Africa; politically stabile with a favourable investment climate

– For Africa relatively low gold tax burden (certain levies increased recently, is it still attractive?) and high labor productivity - Good infrastructure and mining legislation – but the major impediment is the chronic lack of electric power:

– Reduced capacity utilisation and suspended expansion activity

– CAPEX requirement for non-core activity and heavy-duty imports

– Poorer implementation of EHS standards (waste water & mine safety] - All included, Ghana is one of the favourite African destinations for miners

Over 3/4 controlled by 4 players

Sample Canadian companies with Ghana gold assets:

Kinross Gold ± Asanko Gold ± Endeavour Mining ± Golden Star Resources ± Castle Peak Mining ± Ashanti Sankofa ± Abzu Gold

Sample African Interest

Whether Ghana gold or other places across the vast mineral-rich continent, judging by the past M&A activity reports & footprint- a large number of players form only a sample of exit opportunities-looking at early gold assets, but from different angles (strategies & criteria):

Potential investors / partners

Gold is at the heart of this Theme Vitrine , with PIPEs making the investment easier & Africa making it cheaper… Setting a potential PIPE Investment into Gold Mining deal into play as described in the text to be unlocked for ‘a fistful of gold’ : )

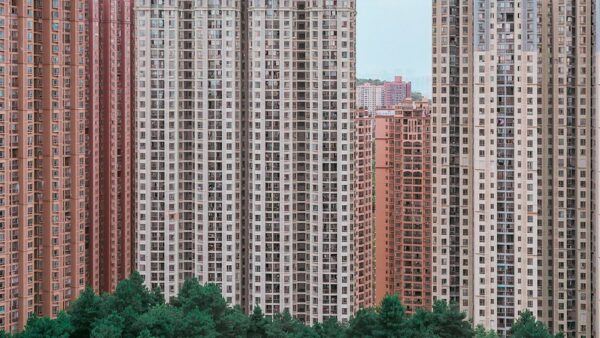

Photo:J.Smith

Just kidding, you can write us with a genuine wish to discuss the opportunity further, and we will send you the password to the third & final section of the PIPE Investment into Gold Mining theme: It includes the experts involved, their stock picking method, the deal size, expected value & the structure…

Theme Related Tracker

There is a particular lesson that history regularly teaches, yet the public never actually learns…

- SBI job rejection over poor credit score: Madras HC ruling stresses financial discipline for banking, finance careerson July 1, 2025

The Madras High Court upheld SBI’s decision to cancel a job offer due to poor credit history, reinforcing the importance of maintaining a clean credit score for careers in banking and finance.

- Thinking of loan settlement? Here's how it can damage your credit score and future borrowingon July 1, 2025

Loan settlement can provide short-term relief for borrowers facing financial difficulties but negatively impacts credit scores. Settled loans are marked as negative events, potentially hindering future borrowing for up to seven years.

- Personal loan: How does it help create a healthy credit mix?on July 1, 2025

Aside from meeting financial needs, a personal loan helps the borrower create a healthy credit mix, which is a blend of different credit accounts on credit report.

- Groww’s switch to demat MFs: What investors gain—and what they could loseon July 1, 2025

Groww’s shift to demat mode for mutual fund investments has sparked user confusion—but it may not be a bad deal. Here’s what investors need to know.

- Short-term or long-term personal loan: Which option is better for your finances? Find out nowon July 1, 2025

Short-term or long-term personal loan: Choosing the right tenure for a personal loan is essential for long-term financial security. It impacts your monthly EMI, total interest, and credit status. Consider your risk tolerance, income, and future plans to find a suitable repayment period.

- How secured credit cards can help you build a good credit score?on July 1, 2025

Secured credit cards are issued against the fixed deposit (FD) opened with the issuing bank. For instance, IDFC First Wow, Sbi Card Unnati and BOB Prime Credit Card

- Avoid these mistakes while making a Willon July 1, 2025

You need to ensure that you cover all the assets in detail.

- The silent tax: How inflation erodes wealth, and what investors can do about iton July 1, 2025

Inflation may not make headlines like market crashes, but it's always working—silently chipping away at your wealth. Here's why real returns, not nominal ones, matter most.

- Personal loan: Major banks charge these interest rates in July 2025on July 1, 2025

Since personal loans – being unsecured – charge a relatively higher rate of interest from borrowers, it is vital to compare the rates charged by different lenders before borrowing

- Overdraft vs personal loan explained: Key benefits, rates and when to choose eachon July 1, 2025

This article compares overdrafts and personal loans and outlines key differences, interest rates, use cases, and repayment structures to help borrowers choose the right credit option for their financial needs.